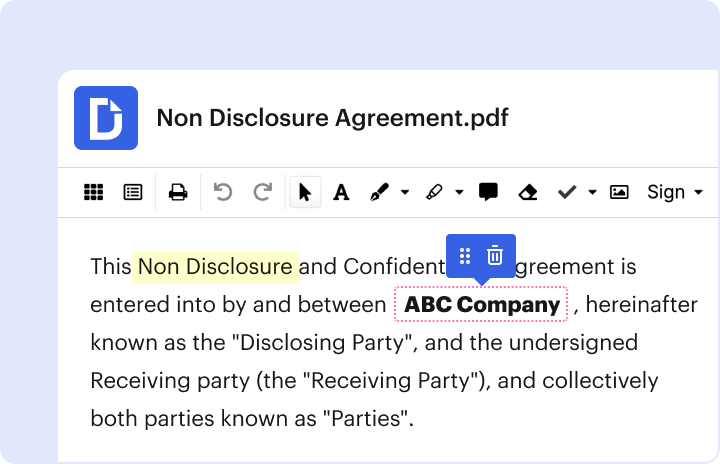

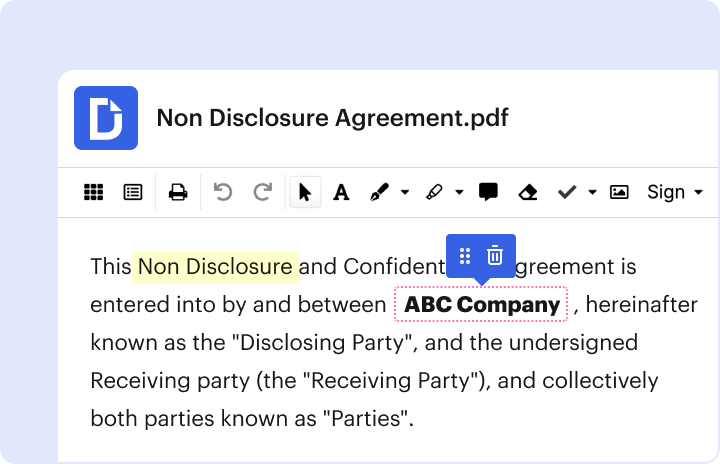

Send common paymaster agreement via email, link, or fax. You can also download it, export it or print it out.

Adjusting paperwork with our feature-rich and intuitive PDF editor is easy. Follow the instructions below to complete Common paymaster agreement form online quickly and easily:

Take advantage of DocHub, the most straightforward editor to quickly manage your paperwork online!

Fill out common paymaster agreement form onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

What is a fiscal agent for income tax withholding?You are a withholding agent if you are a U.S. or foreign person that has control, receipt, custody, disposal, or payment of any item of income of a foreign person that is subject to withholding.

What is an IRS 3504 pay Agent?A Section 3504 agent performs acts such as the withholding, reporting and paying of employment taxes. The Section 3504 agent files one return for each period on behalf of all the employers it represents using its own EIN and address on the returns (aggregate return).

What is an IRS reporting agent?A Reporting Agent is an accounting service, franchiser, bank or other person who complies with Revenue Procedure 2012-32 and is authorized to prepare and sign employment tax returns electronically for a taxpayer. Reporting Agents may transmit their own returns or use the services of a third-party transmitter.

What is the difference between common pay agent and common paymaster?Unlike a Common Pay Agent, the use of a Common Paymaster is not purely for admin simplicity. Since a Common Paymaster is treated as a single employer, those employees are only subject to a single annual taxable wage base for FICA and FUTA tax purposes.

Does Pa allow common paymaster?Common Paymaster Reporting Not Permitted Under the Pennsylvania Unemployment Compensation Law. A common paymaster is one employer within a group of employers that pays the wages of its own employees as well as the wages of the employees of the other members of the group.

common paymaster example common paymaster rules pros and cons of common paymaster common pay agent form common paymaster and common pay agent common paymaster accounting how to set up a common paymaster common pay agent vs common paymaster

Section 31.3121(s)-1(b)(2) defines common paymaster as a member of a group of related corporations that disburses remuneration to employees of two or more corporations on their behalf and is responsible for keeping books and records for the payroll with respect to those employees.

Does Pa allow common paymaster?Common Paymaster Reporting Not Permitted Under the Pennsylvania Unemployment Compensation Law. A common paymaster is one employer within a group of employers that pays the wages of its own employees as well as the wages of the employees of the other members of the group.

What is a paymaster agreement?A paymaster is a neutral third-party that acts as an escrow, receiving funds for the transactions between two separate entities or businesses. The escrow account holds the money as the parties complete their agreements, releasing the amount to the seller upon request.

What Is a IRS 3504 pay Agent?A Section 3504 agent performs acts such as the withholding, reporting and paying of employment taxes. The Section 3504 agent files one return for each period on behalf of all the employers it represents using its own EIN and address on the returns (aggregate return).

What is an IRS 3504 pay Agent?A Section 3504 agent performs acts such as the withholding, reporting and paying of employment taxes. The Section 3504 agent files one return for each period on behalf of all the employers it represents using its own EIN and address on the returns (aggregate return).

Jan 20, 2022 The common paymaster is responsible for withholding, depositing, and paying FICA and FUTA taxes, and filing and furnishing information returns

26 CFR 31.3121(s)-1 - Concurrent employment by relatedThe common paymaster is responsible for filing information and tax returns and issuing Forms W-2 with respect to wages it is considered to have paid under

W166 Wisconsin Employers Withholding Tax GuideUnlike the Internal Revenue Service, Wisconsin does not permit the use of a Common Paymaster. However, a corporation that has several divisions (not