Being without a valued gadget is a painful experience, particularly if you are reliant on it. That's why we've made the process of making a claim on your insurance simple and efficient.

If you just want to get stuck in and tell us about what happened, click below to use our portal to submit your phone or gadget insurance claim.

If you're new to phone or gadget insurance and don't know what to expect, this guide will walk you through everything you need to know. Please follow these steps when it comes to submitting your claim.

Your policy documents highlight your cover. Check these in the first instance.

If you cannot find your policy documents, you can locate them on our website, or you can ask one of our customer service agents to send your documents to you again.

Once you have checked that you are covered, you can submit your claim. You can do this a couple of different ways:

You will need to submit a proof of purchase and any other documents we request to support your claim (here's a handy list of documents you may need). If you're making a theft or loss claim, you may need to submit proof of usage and you will need to report it to the relevant authorities as we will also ask you for a crime reference number.

When submitting a claim, you will be asked a few questions about the event, but this will only take a few minutes to complete.

Once you have successfully submitted your claim, our dedicated team of claims handlers will assess your submission and provide you with a response within 2 working days. You can see all the updates about your claim using our online claims platform.

If your claim is accepted, we will let you know and you will need to pay your excess - this is defined in your certificate schedule of insurance. Once your excess is paid you will either need to send your phone to us, or we will provide you with a replacement device depending on the type of claim you have made.

If you need to send your device to us, please ensure you unlock and wipe your device before packaging it up. You will need to include some policy details like claim number and your full name and address so we know it's your phone when it arrives. We suggest using protective packaging and tracked mail to ensure a safe delivery.

When we receive your device, it will take around 5 to 7 days for us to repair and return the device to you. However, we may find that your device is beyond economical repair (BER). If your phone is declared BER, we will inform you straight away and send you a replacement device instead.

If you need a replacement device, it should take around 3 to 5 working days to reach you.

After receiving your device, it will be covered under our 3 month warranty.

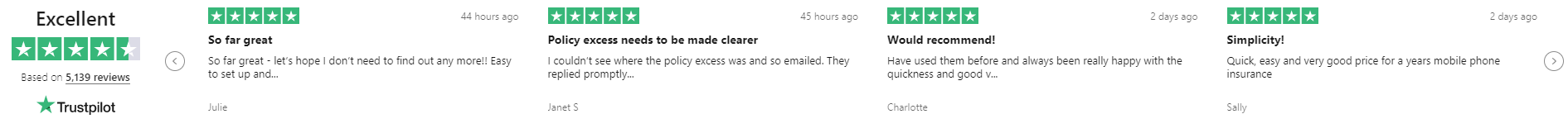

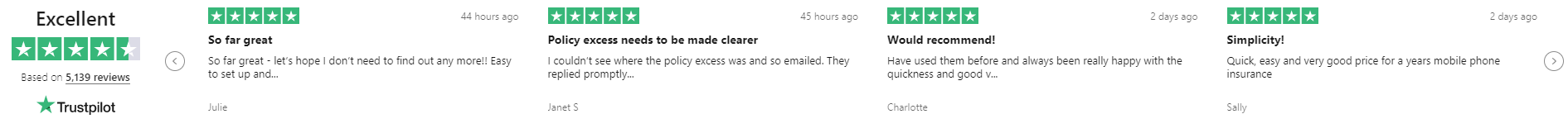

We know that making a claim for any insurance policy can be stressful, and we work hard to make the process as easy for you as possible, but if you're still worried take a look at what some of our other customers have said below.

If you are an Insurance2go Business customer the facility to claim online (link below) is available at any time and there is no requirement to notify the claim by phone before doing so. Please ensure you complete the claim form fully and follow the instructions on the form.

To make a claim, you can use our simple online claims portal which is available 24 hours a day. You can also use it to track the status of your claim at a time convenient to you.

Alternatively, you can contact the Citymain claims team directly:

By phone: 0333 999 7905 (local rate call, 9am – 5.30pm Monday – Saturday).

By email: claims@citymain.com (9am – 5.30pm Monday – Saturday)

By post: Citymain Administrators Ltd, 3000 Lakeside, North Harbour, Western Road, Portsmouth, PO6 3FQ

The information we require when you make a claim will differ depending on the type of claim you are making.

It is standard across all claims that you will need to provide us with proof of purchase for your mobile phone. The proof of purchase must provide evidence that you own the phone and that the phone is less than 36-months old from the time the policy begins. It must also include the make, model and IMEI number of your mobile phone.

If you do not possess or were never issued with a receipt for your mobile phone because they were provided free as part of a contract, e.g. through a mobile phone service provider, you will need to provide evidence of the original order and/or contract under which the mobile phone was supplied.

Unfortunately, if you cannot provide evidence of proof of purchase, your claim may be rejected.

For loss and theft claims, in addition to your proof of usage, you will also need to supply us with a loss or theft report number. These can be filed with your local police station.

If you are making a claim for an incident which happens overseas, we will need information such as copies of your travel documents.

We aim to assess your claim within 2 working days, although we often turn around our assessments quicker than this. You can use our 24-hour claims portal to track the status of your claim.

We keep you informed of the progress of your claim at each step of the process. These communications are usually sent by email – you may need to check your Junk Folders if you haven’t received anything from us.

Once your claim has been assessed and authorised, we will send you an email with instructions of how to pay your excess. You can pay for your policy excess online using the instructions provided, or you can call us to settle this amount which will vary depending on the value of the device insured.

With Insurance2go, there are no limits to the number of claims you can make whilst your cover is in place.

If you are not happy with the outcome of your claim, in the first instance, please write to the Customer Relations Manager of our administrator, CItymain. Their contact details are:

FAO: Customer Relations Manager

Citymain Administrators Limited 3000 Lakeside, North Harbour, Western Road, Portsmouth, PO6 3FQ

Tel: 0333 999 7906 (local rate call).

E-mail: customerrelations@spbuk.com

You also have the right to contact the Financial Ombudsman Service at any time:

The Financial Ombudsman Service,

Exchange Tower,

London

E14 9SR,

United Kingdom

For calls outside of the UK, please call 0044 207 964 1000.

Email: complaint.info@financial-ombudsman.org.uk.

Web Address: www.financial-ombudsman.org.uk

If you wish to complain about an insurance policy purchased online you may be able to use the European Commission’s Online Dispute Resolution platform, which can be found at the following address: http://ec.europa.eu/consumers/odr

The above complaints procedure is in addition to your statutory rights as a consumer. For further information about your statutory rights contact your local authority Trading Standards Service or Citizens Advice Bureau.